The Future Was Now

Real estate’s uneasy relationship with technology

Corcoran Sunshine Talks Keynote: 100 Barclay, New York 2018

Good morning everyone, and thank you to Casey and the Corcoran Sunshine team here at 100 Barclay for the kind invitation to be here, and for the very warm welcome. It’s wonderful to see you all again and I’m thrilled to be back presenting as part of the CS Talks series. The building looks beautiful as always, and it’s a real treat to be here with you all.

Last time I was here a couple of years ago, I spoke a lot about the changing nature of real estate marketing, what self-driving cars might do to cities, and how we might think differently about curating our message for an ever-changing set of audience behaviors. At it’s heart, technology is inevitably fueled by people problems.

And when I got to thinking about what I was going to share today, I thought about a lot of things. Sure, there’s definitely the sense that technology is eating the world. Technology is more ubiquitous than ever, and showing no signs of slowing down. The volume of data being produced is doubling every 2 years. Real estate and technology have often had an uneasy relationship. On the one hand, empowering agents and customers with more information to make better, more informed decisions than ever before. And on the other, holding agents and clients at a distance, and struggling to communicate what it really feels like to live in the place that’s the biggest transaction of most of our lives.

I thought a lot about real estate technology that’s come and gone. Virtual reality seems to be one of those things that has tremendous application for real estate, but never seems to really gain any traction or meaningful scale. The role of social media is flattening out as it becomes harder and harder to surface above the noise within a news feed. Voice technology is changing our homes through our growing relationship with Alexa and Google Home, but these kinds of assistants are useless for helping with most real estate discussions.

However, I do think there’s some interesting things that haven’t even scratched the surface yet. When I think about agents and their technology relationship with their clients, I often think about messaging. Specifically messaging that’s not email or phone calls. So text messages, Facebook messages, What’s App, Instagram messages and all of those ‘dark messaging’ platforms. What hasn’t come to these platforms yet is analytics. And by that I mean a way to interpret, perform sentiment analysis, or really understand what’s going on at scale.

Sure, there’s things like response time trackers, but that’s not really what I mean here. I’m talking about looking for patterns and trends over hundreds of thousands of personal messages, that would be able to help you work better with customers, understand them more effectively, and ultimately grow your business. Now, a lot of this can feel invasive, and perhaps a bit scary. But stay with me here as I share a few more examples of what once seemed scary, but no longer is.

One other thing I thought about was the changing nature of our relationship between technology and our homes. Smart lightbulbs, Nest thermostats that learn your patterns of walking in and out of rooms, refrigerators that can anticipate when you need to buy milk, Amazon magnets that are just a single button push from re-ordering dog food. I still think the kitchen is one of those places in the home that hasn’t really embraced the internet. When I think about those devices in my kitchen, most of them are pretty dumb. They heat things, they cool things, they wash things. None of them talk to each other, and none of them have any idea who I am. And the pace of innovation isn’t that fast here for most of us. For example, I saw a commercial last night for Theraflu Pods. Basically cold medicine you can use in your Keurig coffee machine. Maybe this is just me, but I thought ‘wow, what a great idea’. But it’s not like heating up cold medicine in an easier, more on-demand way is some particularly earth shattering piece of progress.

So this time, when it comes to talking about real estate technology, I think you can’t do that without a discussion of the enormous amount of capital flowing into the space, so I’m going to share some thoughts and insights on what’s currently happening. I’m going to follow the money.

I’m going to outline some thoughts on the rise of new business models to how legacy brands are shifting and adapting, and in parallel, reinforce the notion that there’s no question that we live in uncertain, but exciting times for both real estate and technology.

Coupled with economic uncertainty, especially overseas and the impact of decisions such as Brexit, to political uncertainty here at home, everything I’m going to share with you today is framed as an opportunity. An opportunity to learn about new ways of doing business, new ways of adapting to a turning market, and thriving in that uncertainty.

Earlier this year, Pete Flint, the founder of Trulia, shared that he thought the last 10 years have been all about search. And that the next 10 would be all about the transaction. In fact, that in real estate, we were on the inflection point of a new transaction revolution. And when you think about the rise of Zillow, Trulia, Realtor.com and perhaps even Redfin over the past decade, you can easily see what he’s talking about on the consumer side of things. Since 2008 there’s undoubtedly been a tremendous shift in how buyers especially think about how they find homes online. Achieving unprecedented customer awareness and huge scale, Zillow has been the clear winner here in terms of market share, and with deep pockets fueled by the expansive growth of their advertising and Premier Agent programs, have acquired many potential competitors along the way. Trulia of course, and most notably Streeteasy here in New York.

But very little has happened once that search process has resolved itself to reaching out to an agent. The showing process is still the same as it was 50 years ago. The transaction itself is still a primarily offline one for most buyers and sellers. The closing table is still an analog experience, and the whole process is cumbersome and time consuming. According to The National Association of Realtors, on average, it takes 4.3 months to buy a home and 2.8 months to sell. It’s also very costly, with tens of thousands of dollars tied up in commission, title costs and other fees.

So with the battle for consumer eyeballs essentially over, and I think there’s a strong sense that brokerage websites are increasingly irrelevant and costly in terms of lead generation, with perhaps the exception of a few of the larger national brands such as Redfin, Re/Max and Keller Williams. I’ll not dive too deep into the future of franchises here, given this week’s news, but I think that brokerage franchise websites are having a particularly tough time at the moment.

As we all know, tech has done a lot in the past couple of decades to revolutionize and upturn how we think about information and how we share it with each other. Searching for anything that’s ever happened is no more than a quick Google search away from the phone in your pocket. I miss those arguments at the bar where you and a friend would be trying to remember some obscure actor’s name - those are resolved in a matter of seconds these days.

Messaging or the broadcasting of your innermost thoughts and feelings about the world to hundreds of people is no more than a Facebook post or Tweet away. The Unfollow button has become one of our most trusted and valuable services. Amazon Prime has revolutionized how we think about shopping and the instant gratification of the 1-click purchase, often being cited for the decline of brick and mortar retail of course. PayPal and Venmo have changed the way we think about the exchange of money. Many things that once felt scary, are now simply commonplace.

Think of this in a similar way to how we now think about transportation here in the city. Ten years ago, if someone had said to you that after a party you’d willingly call up and get into a stranger’s car to have them take you home, and that you’d often pay them a premium to do that, you probably would have thought they were nuts.

Or that you’d be lazy enough to order a cup of coffee and a bagel to be delivered from the deli across the street on a Sunday morning instead of going out and getting it yourself (full disclosure, I fully realize this might just be me), there’s a strong sense that services which save time are becoming very, very profitable, and real estate is not immune to this.

But as Pete Flint also mentions, real estate is larger than all of those categories combined, and the transformation that real estate tech could bring to our lives is larger, and more profound, than you might think.

But real estate as an industry has traditionally been very slow to adapt in comparison to other industries, due either to outdated regulation, the inherent offline nature of the process, a lack of agreement on things like data standards, or a whole host of other logistics issues.

But the land grab for who owns the transaction is really still in its infancy, and with a growing number of new brokerages and services entering the industry, supported by deep investment through venture capital, the long-aspired-to vision of a truly end-to-end digital transaction is starting to become a reality, and is resulting in new business models appearing at an accelerated pace in 2018.

As I mentioned before, according to NAR, since 2015, the majority of home buyers start their home search online, primarily with Zillow or Trulia, and primarily on mobile, and then transition to a complicated and largely offline transaction process. This is changing. And changing fast.

Home buyers and sellers have grown accustomed to more control over the transactions and flow of information in their lives, and are increasingly frustrated by the slow pace of change in the real estate industry.

Often referred to as iBuyers, there’s an increasing number of services that are growing market share aggressively across the country, who offer and facilitate the convenience of being able to buy or sell a home in a short space of time, and have customers that are willing to pay a premium in order to do that.

For example, Opendoor are actively changing the showing process. Verifying buyers in advance, and then allowing them to tour homes on their own and unlock the front door with the touch of an app. The convenience here is that buyers can do all of this on their own schedule, not the agent’s. Are there trade-offs here? Sure. Will those buyers be able to tell if the air conditioning is about to give out? Or that the boiler needs repairing? Probably not. But the convenience of being able to not be held to the agent’s schedule is the key value proposition being disintermediated here.

And on the seller side, the service makes an offer to the seller at an expedited pace with a guaranteed cash offer, allowing the seller to move out and progress with their own transactions in their own time, free of having to contend with the speed of the market. The companies let sellers close quickly or take time to move out when it works for them, handle repairs and renovations (if necessary), and then relist the home on the market once the seller has moved out. The promise is speed, convenience, and the certainty of a transaction without having your home on the market for protracted periods of time, and having to go through multiple viewings and offers over several months.

But let’s be realistic here. This kind of behavior is in its infancy, and in the minority. This isn’t going to replace agents in just the same way that Uber isn’t going to replace your car. Like with all technology, it’s a service, an option.

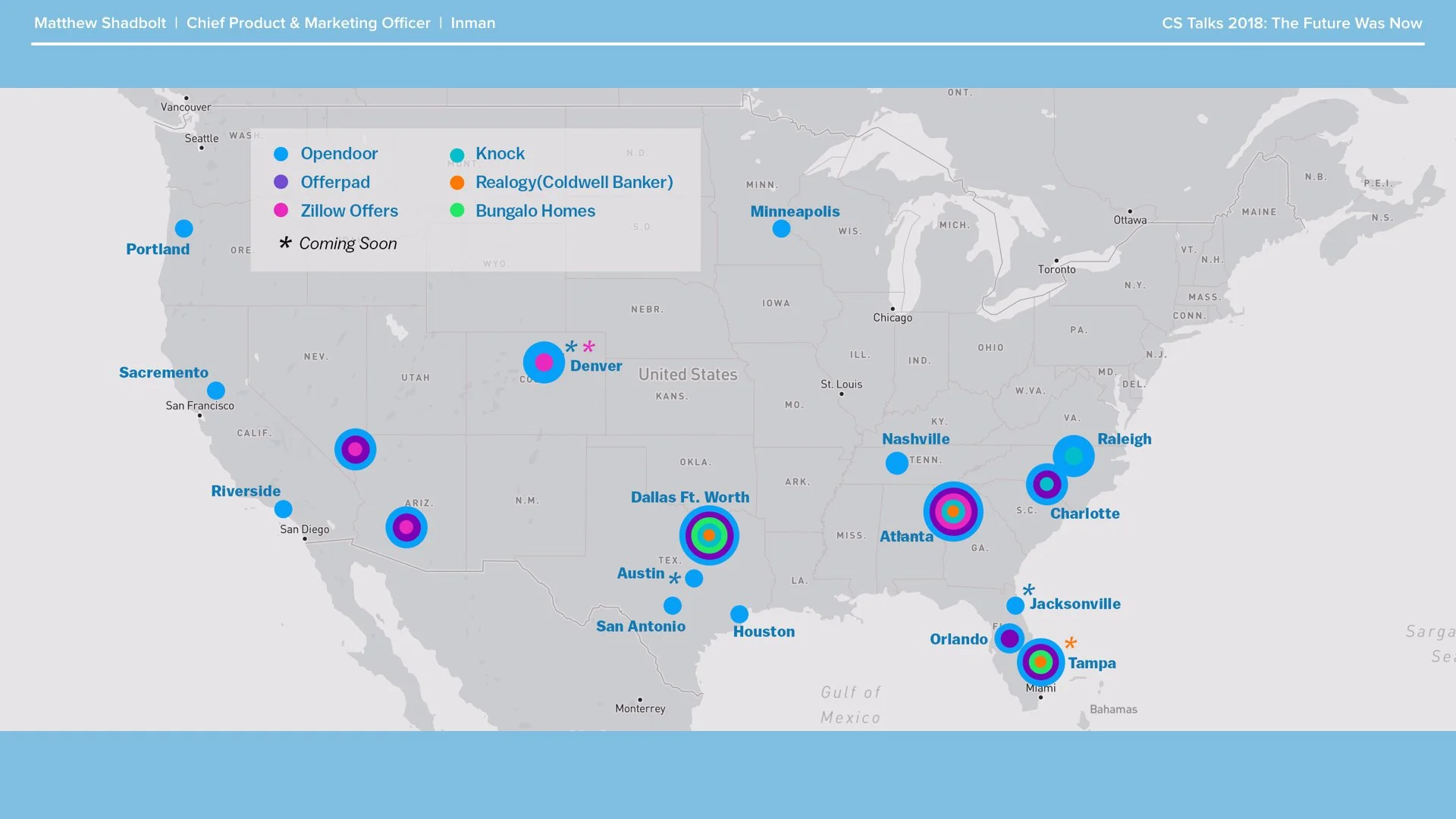

But for some context around how this kind of activity is growing, here’s Inman’s map of what current iBuying or instant offer services look like so far around the country.

So when it comes to investment pouring into real estate, as reported on Inman.com, “$2.7 billion was invested in real estate technology just last month. A month-over-month increase of 132% according to a study published by RE Tech, a Brooklyn-based research firm focused on the real estate technology market.

And while that figure is the highest recorded this year, it was still shy of the $6.5 billion invested in the fourth quarter of 2017.”

One of the biggest and most visible investors, based in Japan, are SoftBank. Their $93 billion Vision Fund, which officially closed a little over a year ago, has invested in telecoms and experienced tremendous growth through their relationship with Chinese e-commerce website Alibaba. Notably, SoftBank are investors in both Compass and Opendoor, with large investments in September of $400 million each. It has invested $865 million in construction-tech startup Katerra, as well a $120 million round in Lemonade, a tech-powered provider of homeowners and renters’ insurance.

As Inman’s reporting continues, “because the residential real estate industry in the U.S. is so large, with many different, specialized sub-markets such as construction, financing, selling and lots more, SoftBank sees opportunities to build successful, profitable and disruptive new businesses that leverage technology across the entire real estate supply chain. Investing in the entire chain allows for efficiencies and collaboration between companies in unprecedented ways.” To some extent this is echoed in CVS’s $69 billion merger with healthcare provider Aetna, where consolidated resources and convenience for the end user are the goal.

Very often when it comes to thinking about technology, we can think of it as a young person’s game. And as the father of an 8 year old daughter, seeing her so easily Facetime with her friends or build things in Minecraft so quickly can be pretty scary. But don’t think of this as behavior specific to younger people. With iBuying for example, those looking for quick sales after a divorce for example, or those needing the convenience of moving to a new home with a new job all find benefit in doing this. But to be clear, I’m not advocating that this is going to replace agents or completely upend how real estate works with Zillow adding an ‘Add To Cart’ button to it’s website. But what I am saying is that for many users, having become easily accustomed to the simplicity and convenience of other on-demand services in their lives, are willing to pay a premium to have that same level of convenience in their home buying process.

And it’s not just the startups like Opendoor who are getting in on this. Zillow’s Instant Offers program is expanding to dozens of different markets very swiftly, Realogy, now under new leadership, is testing out a national iBuyer program with Coldwell Banker, and Keller Williams have been secretly testing an iBuying program this year as well. So when we think about what 2019’s going to look like in terms of technology, convenience around the changing nature of what’s happening with the transaction is most definitely one to watch.

Parallel to this idea of revolutionizing transactional services driven by aggressive venture capital is the impact this is all having back on the brokerage side. I’ve already mentioned that Keller Williams and Realogy are testing iBuyer platforms for their agents, but there’s a strong pattern of acquisition and consolidation happening in the industry at the same time.

The MLS infrastructure is shrinking because of a growing number of mergers and acquisitions, most notably for you local folks what’s recently been going on with Hudson Gateway MLS’s merger with the Long Island MLS to form the New York MLS.

Some brokerage leaders have made recent statements calling for investment in the MLS, which will be fascinating to follow given how much reliance there is upon working with that data across the industry, old or new. Until we can standardize and normalize the database of home inventory across the country, the efficiencies and savings brought by machine learning across the entire MLS still feel like science fiction.

So when I think about real estate technology and what’s in store heading into 2019, I see a lot of opportunity, framed by uncertainty and growing consolidation of effort across the industry. Customer behavior around paying premiums for services that save time has already happened. But there’s no question that there’s enormous interest in making home buyers’ and sellers’ lives easier through the building of streamlined transactional services, and with some pretty deep pockets in play, the days of thinking about search are over, and the days of thinking about optimizing on what it feels like to buy a home are just beginning.

I hope you enjoyed my stories, thank you.